A bombshell has dropped in mortgage land.

We’ve said for some time that document fabrication is widespread in foreclosures. The reason is that the note, which is the borrower IOU, is the critical instrument to establishing the right to foreclose in 45 states (in those states, the mortgage, which is the lien on the property, is a mere “accessory” to the note).

The pooling and servicing agreement, which governs the creation of mortgage backed securities, called for the note to be endorsed (wet ink signatures) through the full chain of title. That means that the originator had to sign the note over to an intermediary party (there were usually at least two), who’d then have to endorse it over to the next intermediary party, and the final intermediary would have to endorse it over to the trustee on behalf of a specified trust (the entity that holds all the notes). This had to be done by closing; there were limited exceptions up to 90 days out; after that, no tickie, no laundry.

Evidence is mounting that for cost reasons, starting in the 2004-2005 time frame, originators like Countrywide simply quit conveying the note. We are told this practice was widespread, probably endemic. The notes are apparently are still in originator warehouses. That means the trust does not have them (the legalese is it is not the real party of interest), therefore it is not in a position to foreclose on behalf of the RMBS investors. So various ruses have been used to finesse this rather large problem.

The foreclosing party often obtains the note from the originator at the time of foreclosure, but that isn’t kosher under the rules governing the mortgage backed security. First, it’s too late to assign the mortgage to the trust. Second. IRS rules forbid a REMIC (real estate mortgage investment trust) from accepting a non-performing asset, meaning a dud loan. And it’s also problematic to assign a note from the originator if it’s bankrupt (the bankruptcy trustee must approve, and from what we can discern, the note are being conveyed without approval, plus there is no employee of the bankrupt entity authorized to endorse the note properly, another wee problem).

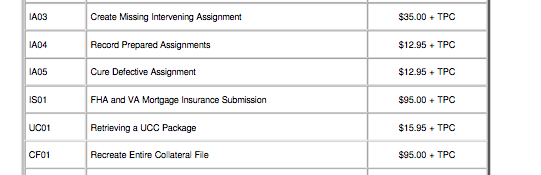

We finally have concrete proof of how widespread document fabrication was. For some reason the ScribD embeds aren’t working correctly, you can view the entire Lender Processing Services price sheet here, and here are the germane sections.

Not only are there prices up for creating, which means fabricating documents out of whole cloth, and look at the extent of the offerings. The collateral file is ALL the documents the trustee (or the custodian as an agent of the trustee) needs to have pursuant to its obligations under the pooling and servicing agreement on behalf of the mortgage backed security holder. This means most importantly the original of the note (the borrower IOU), copies of the mortgage (the lien on the property), the securitization agreement, and title insurance.

Also notice that there is a price for creating allonges. We discussed earlier that phony allonges have become the preferred fix for the failure to convey notes properly:

The cure for the mortgage documents puts the loan out of eligibility for the trust. In order to cure, on a current basis, they have to argue that the loan goes retroactively back into the trust. This is the cure that the banks have been unwilling to do, because it is a big problem for the MBS. So instead they forge and fabricate documents.

The letter in particular mentions an allonge. An allonge is a separate sheet of paper which is attached to a note to allow for more signatures, in this case, endorsements, to be added. Allonges have had a way of magically appearing in collateral files while trails are in progress (I’ve seen it happen in cases I was tracking; it’s gotten so common that some attorneys warn judges to be on the alert for “ta dah” moments).

The wee problem with an allonge miraculously being discovered is that the allonges that show up are inherently in violation of UCC (Uniform Commercial Code) provisions (UCC has been adopted by all states, a few states have minor quirks, but the broad provisions are very similar).

An allonge is NOT to be used unless all the space on the original note, including the margins and the back side of pages, has been used up. This is never the case. Second, an allonge has to be so firmly attached to the original document as to be inseparable. Thus an allonge suddenly being discovered is an impossibility (well impossible if it were legit), yet it seems to happen all the time.

This revelation touches every major servicer and RMBS trustee in the US. DocX is a part of of Lender Processing Services. Lender Processing Services has three lines of business, the biggest of which is “default services”, representing close to half its revenues of this over $2 billion in revenues company. DocX is its technology platform it uses to manage its national network of foreclosure mills. Note that DocX closed one of its offices in Alpharatta, Georgia earlier this year, per StopForeclosures:

On April 12, 2010, Lender Processing Services closed the offices of its subsidiary, Docx, LLC, in Alpharetta, Georgia. That office was responsible for pumping out over a million mortgage assignments in the last two years so that banks could foreclose on residential real estate. The law firms handling the foreclosures were retained and largely controlled by Lender Processing Services, according to a Sanctions Order entered by U.S. Bankruptcy Judge Diane Weiss Sigmund (In re Niles C. Taylor, EDPA, Case 07-15385-sr, Doc. 193). Lender Processing Services, the largest “default management services company” in the country, has already made at least partial admissions that there were faults in the documents produced by the Docx office – although courts and homeowners were never notified. According to Lender Processing Services, over 50 major banks use their default management services. The banks that especially need the services provided by Lender Processing Services include Deutsche Bank, Citibank, Wells Fargo and U.S. Bank, acting as trustees for mortgage-backed securitized trusts. These trusts, in the rush to securitize mortgages and sell them to investors, often ignored the critical step of obtaining mortgage assignments from the original lenders to the securities companies to the trusts. Now, years later, when the companies “servicing” the trusts need to foreclose, they retain Lender Processing Services to draft the missing documents. The mortgage servicers, including American Home Mortgage Services, Saxon Mortgage Services, and American Servicing Company, never disclose that the trusts are missing essential documents – they just rely on Lender Processing Services to “fix” the problems. Although the Alpharetta office has been closed, Lender Processing Services continues to mass produce “replacement” assignments from its Jacksonville, Florida, and Dakota County, Minnesota offices. Law firms retained by Lender Processing Services also often use their own employees, posing as officer of Mortgage Electronic Registration Systems, to produce the needed Assignments.

So wake up and smell the coffee. The story that banks have been trying to sell has been that document problems like improper affidavits are mere technicalities. We’ve said from the get go that they were the tip of the iceberg of widespread document forgeries and fraud. This price sheet provides concrete proof that the practices we pointed to not only existed, but are a routine way of doing business in servicer and trustee land. LPS is the major platform used by all the large servicers; it oversees the work of foreclosure mills in every state.

And this means document forgeries and fraud are not just a servicer problem or a borrower problem but a mortgage industry and ultimately a policy problem. These dishonest practices are so widespread that they raise serious questions about the residential mortgage backed securities market, the major trustees (such as JP Morgan, US Bank, Bank of New York) who repeatedly provided affirmations as required by the pooling and servicing agreement that all the tasks necessary for the trust to own the securitization assets had been completed, and the inattention of the various government bodies (in particular Fannie and Freddie) that are major clients of LPS.

Amar Bhide, in a 1994 Harvard Business Review article, said the US capital markets were the deepest and most liquid in major part because they were recognized around the world as being the fairest and best policed. As remarkable as it may seem now, his statement was seem as an obvious truth back then. In a mere decade, we managed to allow a “free markets” ideology on steroids to gut investor and borrower protection. The result is a train wreck in US residential mortgage securities, the biggest asset class in the world. The problems are too widespread for the authorities to pretend they don’t exist, and there is no obvious way to put this Humpty Dumpty back together.

Yves,

Under Sarbanes-Oxley, aren’t officers of the companies on the hook personally and criminally for this kind of complete failure of internal process control? It’s my understanding from personal experience that officers have to sign their names attesting to the proper accounting and risk/process control for any material transaction. I have sat in committee meeting after committee meeting going over each month’s transactions so the officers are familiar with the material before signing. But that was not in mortgage banking, all the same, Sarbanes-Oxley was aimed more at the banks than the industry I work in (regulated utilities).

Aren’t the officers in for personal liability here? Regardless of the other, more direct issues such as fraud, perjury, conspiracy etc.?

Not to mention what’s to become of the real estate industry. Are there titles or are they null and void once all this junk is layered on top? What happens if I ask for the title to my house? When I paid my car off they mailed it to me. Seriously, would you lend someone a quarter of a million dollars if you couldn’t repo the collateral? Is it that bad of a clusterbomb? It seems to reach beyond foreclosures to securitization generally, in which case no house bought since, say, 2005 may have a clear title. Or am I mistaken? I hope I am.

Keep it up Yves, these are body blows but the truth will out.

–Jim in MN

Jim,

SOx is nowhere near as I robust as people are led to believe. None of the securities laws/regulations are. (There really is no such thing as transparency.)

As to SOx, you’re correct that officers have to sign SEC quarterly and annual filings attesting to the fact that appropriate procedures have been followed, but officers are allowed to reasonably rely on their subordinates’ assertions to that fact. So, the officers are advised by outside counsel to have their subordinates sign documents verifying that all the rules are being followed. Once tried-and-true procedures are officially in place, this is all that officers really do.

As to officer liability, public corporations take out D&O (directors and officers) insurance to cover liability for negligence (and a little broader to include the Business Judgment Rule). The way you play the game is to make sure you check all the boxes that you’re supposed to check in arriving at your conclusion. This is pretty easy to do.

As to your questions about title, based on my own experience, when you pay off your mortgage, they don’t send you title because the title to your property is already in your name. Rather, the mortgage holder sends a notice to your county/city relinquishing their claim on your property. Based on the stuff that Yves and Calculate Risk have been publishing lately, that gives me little solace.

Tao,

You say “the mortgage holder sends a notice to your county/city relinquishing their claim on your property.”

In Texas it doesn’t necessarily work that way.

Once upon a time I paid the note off on a house I owned and the bank never sent me a release of lien. The originating bank had been acquired by another bank and so the originating bank had assigned the note to another bank prior to my paying off the note.

About 10 years after paying the note off I wanted to sell the house but could not until I obtained a release of lien from the asignee (the bank that bought my note from the bank that originated it in the first place). Fortunately the asigneee was another local bank and I was able to find a bank officer of the successor bank who was willing to sign a release of lien.

I was told that is incumbent upon the homeowner, not the bank that is the current owner of the note, to make sure he gets the release of lien when the homeowner pays off the note. I would recommend that anyone who pays off a note to immediately contact the bank that is the owner of the note and request/demand a release of lien on the note. If you don’t have this, you might find it impossible to sell your house.

DownSouth,

Good point. The laws do vary from state to state, and I’m sure that compliance with the laws varies, as well.

Down South, in Texas they have squatters rights and after 10 years, the property is yours. But, you are correct and it would be a pain in the ass to transact clear title without the release. We are in the real estate business and the releases are always demanded and recorded.

As far as the assignments go. I closed loans I brokered through Colonial back in the early 1990’s and I was always required to sign an assignment at closing, though I really never funded anything. I also did mortgages for Temple-Inland and I don’t recall them having assignments. I think I was paid differently by Temple, so they probably considered the loan closed in house. I am amazed that this paperwork was not done, especially when it was clear that these loans were going to be sold and title transferred. This is so elementary that one would have to suspect fraud in the paperwork itself and the entire design to destroy the paper trail detailing where the paper had passed. It was clear to me that I was signing those assignments to tie liability for fraud and errors to me. I could have gotten back in the mortgage business during the boom, but I didn’t want my signature on anything to do with the bomb I know was about to explode.

One more thing. They say no one saw this coming. They all saw it coming, which is why the paper trail has been obliterated. Every real estate lending boom in history has been soaked with fraud and blown up. This will include the ones still going around the world in Canada, China and Australia. I’m sure there will be public executions in China. There appears to be benign neglect in the US.

I’m not suggesting that the intent of the law will be upheld (although human nature being infinitely adaptable, never say never), just that SOX is there and has individual officers’ names on the hook…in principle.

Merely a reminder to those who look, but don’t post. Go get ’em. Plenty of legal, moral, and public good ammo.

I don’t believe SO has anything to do with mortgage fraud. Just the financial statements and stuff filed with SEC. So these companies can file false affidavits all they want and the CEO’s won’t be going to prison anytime soon.

Jim, There is also a deniablty gap in Sarbanes Oxley, as big as the Grand Canyon. You will note that every disclosure and requirement is prefaced with, “to the best of my knowledge”.

As Jonesing alluded this is not robust legislation. It is merely window dressing for the markets with a bit of compliance extortion thown in to pay for it..

Let us hope the worm will turn. Clearly there are plenty of deserving worm prey (rotten apples) out there.

Am I holding my breath> uh no.

I don’t believe you need Sarbanes Oxley to prosecute the fraud going on here. This is so widespread that the normal internal control of the process was destroyed. People on the bottom don’t make decisions like this. In fact, an audit of 50 files out of thousands should have detected this. We are talking about files with 50 sheets or less of paper in them in general, arranged in perfect order. We are talkinga about something only an idiot or a defrauded party would pass on. These are multi-million and I am sure at times billion dollar pools. There is nothing more plain in real estate than clear title. Go price title insurance if you don’t think so. They insure nothing, except that the paperwork is in order at closing and act as surety with right to go after the warrantor should something go wrong (subrogation). This is like buying a new car without a motor based on sound effects from under the hood. From the start of the process to somewhere the ownership lies now, there was blatant fraud.

Isn’t Fidelity National Title affiliated LPS? So you have basically the same entity falsifying documents of title on properties whose titles it has insured?

No, LPS is a separate public company from Fidelity National Title.

It wouldn’t make any difference. Title insurance is to assure the sellers warranty is good and excludes all acts after closing. You don’t have insurance after the date your auto insurance expires. This is a different chain of title and it isn’t title to the property, but title to who holds the security interest created after the fact. All the title companies I ever dealt with followed the instructions from the mortgage company. I will concede that when there were downpayments, some title companies would close what were known as double contracts, which were scams to avoid downpayment. A lot of them went to prison.

HA-ha! The whole system is a joke.

Mr. Foley has been the Chairman of FNT, a majority-owned subsidiary of FNF since September 2005. He has been the Chairman of Fidelity National Financial, Inc., at Fidelity National Title Group, Inc. since October 2006. He served as an Executive Chairman of Lender Processing Services, Inc. from July 2008 to March 15, 2009. He served as the Chairman of Lender Processing Services, Inc. from May 2008 to July 2008 and Executive Chairman from July 2008 to March 15, 2009.

And Eric Holder is too busy suing Arizona to look into this.

Yves,

Check this out …looks like someone let the wolf inside the hens nest!!

LPS’s Aptitude Solutions Software In Your County Courts & Land Records???

Hurry before it magically disappears like other stuff from my site!

http://stopforeclosurefraud.com/2010/10/02/must-read-is-lpss-aptitude-solutions-software-in-your-county-courts-land-records/

What a mess.

I assume that individuals who lost their house over the past few years can now sue for the proper documents to be produced?

I also assume that Hope’n’Change will find some evil way to smooth this over for the industry.

“I also assume that Hope’n’Change will find some evil way to smooth this over for the industry.”

Such a statement made 15 months ago, I would’ve scorned it real bad.

Now, I can only concur: Timmy and Larry will find a way to convince Obummer that it would be a national security problem to “look backward” on these practices, since it could jeopardize the all important financial services industry.

You just watch: Holder will find a way to invoke “other pressing priorities” (Obama’s due process-free assassinations programs would be a good candidate) to refuse to assign resources to this problem.

Wall Street can sleep soundly.

The result is a train wreck in US residential mortgage securities, the biggest asset class in the world. The problems are too widespread for the authorities to pretend they don’t exist, and there is no obvious way to put this Humpty Dumpty back together.

Well said.

On Friday, Old Republic National Title Company announced it will no longer write policies on foreclosed GMAC or Chase properties.

Conversely, Fidelity National Title issued a statement on Friday that it did not believe the problems with the foreclosure process would have “a material adverse impact.”

Could it be that Fidelity knows that their company–LPS–has infiltrated and controls many of the county recorders’ offices? It will not be a problem because, not only can LPS create the forged affidavits and assignments, it can also retroactively insert them into the county records?

Meanwhile these pathetic, do-nothing judges have been giving these financial institutions two thumbs up because they know the banks’ army of lawyers are more likely to reverse them on appeal than the homeowners who have just been evicted and cannot even afford to appeal.

“LPS Aptitude Solutions to provide the OnCore Acclaim system for the recording and capture of real estate, vital records and County Clerk documents. OnCore Acclaim will also maintain document data and images, provide redaction capability…”

How convenient.

I think it’s time for some independent security specialists to take a look at the guts of OnCore Acclaim and see what kind of back doors the program includes. And to check server logs to see just what kind of offsite access and from which IP addresses has been made to whatever this software package has been running on.

LPS is not Fidelity National Financial’s company – it is a separate public company. Different operations, management & employees.

OK…Here is the time bomb…couldn’t resist since it was deleted from my site and I just have to replace it.

Please take this before it’s gone …again!

WHAT LPS & THE MILLS DON’T WANT YOU TO KNOW…WHO REALLY OWNS THE NOTE!

http://stopforeclosurefraud.com/2010/10/03/what-lps-the-mills-dont-want-you-to-know-who-really-owns-the-note/

LOL…I am certain that the aforementioned software package was supplied very cheaply if not for free, just to help the courts clear the backlog of forclosure suits.

I may be wrong. But, with this type of technologic capability every property title in the Unied States might be brough into dispute, unless it involved an original landgrant or homestead.

A few days ago I mentioned the mess in the third world, where lack of clear title stiffles development and promotes ‘bigger gun’ ownership. These are very dark days.

This brings to mind Hernando de Soto Polar’s idea that poverty in the third world results (to one degree or another) from the lack of documented land title, i.e., people “own” homes or farms, say, but there is no title registration of their “ownership”, so the property cannot be used as collateral for credit and investment. He contrasts that with the fist world, where such title registration is routine…but could the loan servicing problems we’re seeing lead eventually to a weakening of property rights we take for granted? Maybe not, but fifty years ago we weren’t worried about our manufacturing base being exported either. about

Fist world, first world, whatever.

Great thought, and something to think about. We know that the institutions and people involved in this do everything for a purpose, and the underlying purpose is usually based on their constant: to enrich themselves while ‘de-powering’ the others. They also realize that they cannot try to do too much of the latter part in any large swoop as we would recognize it. I understand they did have one of these securitized loans litigated early on to test the court before they proceeded. I read so much on this that I cannot cite the case right now, sorry.

While there may be funny business going on in that document, the “do not email about this” bit is probably not intended as a “don’t tell anyone!” message, but as a “we have another process for this” message. If you read the preceeding half of the sentence, they outline what the expected path for handling issues with the document are. It’s fairly common in these kinds of systems to request users not email, in that they want a ticket filed on the issue for work tracking, etc., and the email won’t meet their requirements.

The “don’t tell anyone” part usually goes unsaid with internal documents.

Yxes, excellent post! Thank you for bringing this to our attention.

This however, is the tail of the beast. We have never had an opportunity to see details on the fraud and corruption during the loan origination process. I would suspect, given what is now obvious, is that it was a process fully as corrupt as what we see now.

The price list is “priceless”. Again, I wonder, who pays? I’m sure that at some point the note holder pays for all of this chicanery too. These guys in the middle are working both ends of the deal, the home owner, and the note holder and charging everybody fees. Then just like in the stock market, it’s the churn, baby!

The reason why things like physical possession of a note, wet ink signature of assignation at all transfers, allonges inadmissible when root document permits further signatures, and so forth became _firmly_ embedded in the law on these issues is that land fraud had a very extensive place in American history, certainly in the 19th century. Every kind of fraud and chicanery to seize anothers assets in court was used time and again by the rich against the hicks et. al. to grab their land, with bought-and-paid-for judges quick to rule on what was in front of them. So what was _supposed_ to be in front of them became firm and standardized. Now, of course, we have ‘financial innovation’ to get around the pesky problem of clear claim to title between malefactors of great wealth and the little people’s assets.

When I first read about the structures of MBSs and their serviceing bacy in 2007 when the market for them seized up and the bubble they bloated went limp, I thought to myself, ‘These arrangements CAN’T be legal.’ The whole edifice fo pools and servicers seemed specifically constructed to allow those without clear claim to assets skim the revenue stream from them without having to accept any liability to the mortgagee. Not cricket, in a phrase. But when prices were going up, nobody but nobody cared. “Documentation? That’s so 20th century. Everythings digits in the cloud now, am I right?” But now that asset prices are declining with as much more to go as has come, the losses end up on _somebody’s_ spreadsheet. And now we find that these securitization structures are, well, functionally illegal. Doing things that they are not empowered to do under the law. Criminal enterprises, in effect. . . . Right. Just like they always were.

Where’s RICO with his gat when we need a few gangbusters, is what I want to know?

So glad I rent.

I heard Sarah Palin posted the NC article on her Facebook page with the comment…

So this is how Obama the socialist muslim will seize all private property. Obama and the Wall Street firms that bankrolled his campaign have corrupted the land title process.

He’s a clever guy, that Manchurian Candidate.

http://www.conservatives4palin.com/2010/04/governor-palin-exposes-hypocrisy-in.html

This is going to be fun to watch.

The idea that the Republicans have any moral bona fides when it comes to issues of corporate corruption and deregulation is laughable in the extreme.

Would those be the same Wall Street firms providing financial backing to the teabaggers? (anyone who hasn’t gotten the word needs to google on:

“Dick Armey” “tea party” “wall street”)

Some cans of worms shouldn’t be opened, even if Sarah Palin has a can opener and is looking for something to use it on.

If this kills my current home sale for some reason I am not going to be happy. If I pay off the mortgage there shouldn’t be a problem, right?

My problem may occur when I buy another house and try and get clear title because I will likely purchase a fixer that is bank owned…..Hmmmmm.

I wonder

If these false documents are transmitted by mail or wire ?

And is this an opening for federal action under mail / wire fraud ?

LPS is the tail that is wagging the dog. Problem is the tail has fleas.

Obama let the banks continue life as usual from the very beginning. He never proposed an FDR HOLC like solution to the problem of foreclosures. Now it turns out that the lender behave like a terror organization in civilian life. The government can intervene and let the bums Bowles and Simpson drop their intended butchery of social security investigates the lenders. People want to see lenders go to jail, want them to lose the money they tried to retrieve illegally and way too many want freeze foreclosures and may be even reversed.

Indeed, give a bunch of crooks $15 trillion with no questions asked:

http://www.ritholtz.com/blog/2009/06/bailout-costs-vs-big-historical-events/

And they’re still crooks!

Shocking!

“By engaging in a pattern of racketeering activity, specifically ‘mail or wire fraud,’ the Defendants subject to this Court participated in a criminal enterprise affecting interstate commerce.” (Compl. para. 231) Foster, et al. v. MERS, et al., Case No. 3:10-cv-00611 (W.D. Ky. filed Sept. 28, 2010). The class action complaint against MERS, LPS, and other conspirators is 124 pages long.

I imagine other lawyers all over the country are scrambling to hit these bastards with class action suits.

Yves,

Per your request, the uproariously funny member and self-described “word mangler” of the Calculated Risk commentariat, Juvenal Delinquent, has suggested for you the following tag line for the foreclosure fraud debacle. Drum roll……………………………………….

“THE EMPEROR HAS NO CLOSE”

(And, knowing Juvenal Delinquent, he will have dozens more for you.) Please stop by and say to us over at CR, Yves…you have lots of fans over there.(And I’ll remind everyone to buy your fantastic book, ECONNED. :-)

LOL.

Yes indeed, wake up and smell the coffee

It was Basel II regulators who authorized the banks to leverage themselves 62.5 to 1 when lending or investing in something related to a triple-A, which allowed a 1 percent margin to morph into a 62.5 percent return on poorly defined bank capital, precisely that stuff that big bonuses and too big to fail banks are made of, which created and insatiable demand for these MBS.

And the market, given the extreme scarcity of real triple-As did what markets normally do, they kept the customer satisfied, and supplied plenty of Potemkin type triple-A rated securities.

And now Basel III, though with much better defined bank capital, allow the banks to leverage 71.4 to 1 when investing in precisely the same type of securities that set of the current crisis.

So be very careful with decaf, you sure are in need of much strong coffee!

With regulatory capture, the distinction between the regulator and the regulated is extinguished. There has been regulatory capture by the banks for decades.

In other words, the banks are the regulators, and they loosened reserve requirements to suit themselves. To insist on maintaining the fiction that the “regulators” somehow victimized the banks is silly and only serves to let the banks out of taking responsibility for their mistakes (and outright criminal behavior).

Furthermore, nobody made the banks commit fraud. There is a vast, bright line between acting in enlightened self-interest and engaging in criminal behavior. If being greedy (even understandably so) were an excuse for fraud, it wouldn’t be a crime.

One word – WOW!

Yves said “The story that banks have been trying to sell has been that document problems like improper affidavits are mere technicalities.”

These are not mere technicalities. I do a little genealogical historical research. In the process I ran across what we would call bizarre cases.

About 1830 the owner of a 5,000 acre tract gave 500 acres of the tract to another man by verbal gift. When the 5,000 acre tract was sold there was an exception for any property which had been transferred. About 25 years and two owners later the owner of the 5000 acres filed a trespass action against the daughter of the man who supposedly owned the 500 acres. The daughter was acquited. About 2 years later the owner of the 5,000 acres filed a civil suit against the supposed owner of the 500 acres contesting his claim to the property. Depositions of witnesses would show that the supposed owner of the 500 acres did not have anything in writing. After about a year the plaintiff withdrew his suit and he was forced to pay the legal fees of the supposed owner of the 500 acres. About 2 years later there was an altercation and the 5,000 acre tract owner had a relative killed. The supposed owner of the 500 acres had two sons convicted of manslaughter and imprisoned where they died about 2 years later. All of this because a verbal gift of 500 acres had not been formalized in a deed recorded at the courthouse.

I have seen a case in the very early 1800s where property was sold by assignment with nothing recorded for almost a decade. Three assignments later a buyer demanded a formal deed. Justices of the Peace collected signatures verifying signatures and the release of the wives’ Dower rights. Then a new deed was filed and the JP’s sworn testimony was added to the record.

In another case property was divided among family members in a last Will made in the late 1700s. The will was apparently never probated. (I never found a copy or a reference to it.) Decades later members began to deed their interest in the property in what I guess we would call a Quit Claim deed today. Sometime later an owner of the property had to go to all the living decendants of family and get their signatures agreeing to the sale of the property. The family was scattered across at least 3 states.

By the late 1800s the deeding of property was very formalized in the states where I have done research. This was done for very good reasons, not to create some revenue stream for the government.

As Yves has documented, the transfer of mortgage liens and notes has also become very formalized. And as she has argued, for very good reasons.

Banks depend on technicalities every day and now they would like the courts to ignore a few!

Dear Yves,

Great work on this since the beginning.

But why focus only on foreclosure cases? Clearly, the clouded title chains and assignment fraud are not the result of foreclosure proceedings.

Rather they are embedded in the securitization process as a whole. In other words, all notes and mortgages that were securitized since 2005 or earlier contain faults in their title chain and have been subject to illegal conveyances.

Obviously this creates problems for foreclosures as lenders cant prove legal standing. But that endemic problem has implications for all Notes, not just the delinquent ones.

What about PERFORMING notes? Cant non-delinquent borrowers request proof that current lender is rightful owner of note thus having a legal claim over mortgage payment? If the lender or servicer cannot prove ownership or adequate / legal assignment, can not the borrower stop making all payments until title chain is free and clear?

The real question is … why is Wall Street not reacting more than it is? Technicality or not, it seems to be believing that it wont have a material adverse impact.

If performing notes are also impacted … would that still be true?

We are getting ready to just exactly what you describe. We are paying off our loan, but the mortgage servicer recently – get this – asked US for a copy of the original mortgage paperwork as they do not have any records. In addition, they don’t even know who the signors on the mortgage were (they think it was just my spouse, but we both signed). We have no way of knowing if they are even the legal servicer – we could keep paying them for years, and then have someone else pop up and demand the money. We are getting ready to hire an attorney to help us figure this mess out because we want to sell this house in 8 years, and we are not sure we will be able to get clear title.

Wall Street and the Banks have reacted: pushed through the passage of the Interstate Recognition of Notarizations Act of 2010 which not only had languished since 2007, and had not passed votes twice in the House, AND of which the lobbyist himself who wrote it said that he did not even expect it to be put for a vote (was seeking an opinion!), as W-S & banks first outward act.

Regarding the clouded title and unknown lenders: Neil Garfield’s site, Livinglies, offers a search which, as I understand it, includes ALL the pretender-lenders of your particular securitized trust. Then a Release of Lien would have to be obtained from each of them and filed to possibly get the cloud of the securitization off your home. I would check with a Title Officer and attorney first to be certain of what all is required.

@ Neil D….

“So glad I rent.”

Indeed. Why own when you can rent. Apparently banks completely agree and have been renting documents accordingly.

So, the next time I buy a house I think I will incorporate myself so that if I run into title problems, I will be able to walk away without any of the moral issues that I would have if I were just a regular person and couldn’t morally walk away from a mortgage.

Seriously, have we gotten to the point where people don’t go to jail for counterfeiting documents and submitting them to a court with signed affidavits to execute a fradulent transaction? We are rapidly declining to the legal protections one would expect in Russia, Venezuela or Zimbabwe.

If laws like Sarbanes-Oxeley can’t be used for going after higher-ups in these types of situations, then they should be stricken from the books as they impose large costs on law-abiding firms while not preventing fraudelent books in non-law-abiding firms.

The only thing worse than bad regulation, is expensive bad regulation.

I doubt that thre Feds want to look into this too much due to the sheer magnitude of the MBS out there that could be shown to have serious problems with their claims on assets. They would need to have a fix in mind before they could move because otherwise, they could precipitate 2008 all over again.

The irony here is that the assets (mortgages and houses) actually do exist, they just don’t have the paper trail to link all of the pieces up so the national asset-base is unchanged even thought the MBS’s may get hammered. This is different from Madoff who simply made up the assets. However, it is evidence of massive greed and incompetence on the part of the financial sector who didn’t want to put the hard work in of tracking and transferring notes.

I love the price list (if real). This is “good” business practice by a firm looking to have a solid contract with their client with clear scope and billing items. Unfortunately, it shows a complete absence of morality by clearly scoping a series of illegal steps within a well-defined business practice. Shades of Michael Corleone (fictional) and Meyer Lansky (non-fictional). Could RICO be far away?

At what point will states simply outlaw all MERS type assignments? They’ve lost loads of money on avoided recording fees if nothing else.

There are several states already who have “outlawed” all MERS assignments, and at least one Federal Court District (9th-Ohio) dismissed for one reason (Complaint pre-dating the Assignment), but because the Defendants did not defend, the judges could not dismiss for their real cause: MERS does not receive standing via ownership, therefore MERS cannot confer it.

That federal court received the cases based on an option of Diversification so we do not see many filed federally to get that ruling filed. Inches at a time!

In the interest of fairness and even handedness, I think it is important to present the viewpoint of Lender Processing Services as articulated at their web site:

Default Title and Closing

Streamline the Default Title Process to Reduce Costs, Simplify Processes and Increase Efficiency

The default title and closing process is complex and challenging from a local standpoint – and gets even more cumbersome to manage on a nationwide scale. LPS Default Title and Closing provides a single point of contact solution for nationwide integrated, end-to-end default title and closing.

Our full-service integrated solution eliminates errors and delays that can result from employing multiple title companies, while providing seamless service and consistent quality control throughout the entire default cycle. You can achieve savings by utilizing traditional title products which can be updated at REO, attain lower search and exam fees and receive REO discounted rates on owner’s policies.

The program also shortens closing timelines by simultaneously opening title and completing curative work while the property is being marketed, as well as whenever possible, using the same title agent for both foreclosure title work and REO title and closing.

Our national default title and closing services utilize a blend of local and centralized title production to achieve superior timelines, provide quality title products and reduce costs.

Additional Benefits:

* LPS Default Title and Closing integrates with most industry-leading technologies to improve timelines and streamline processes.

* LPS Default Title and Closing works to expedite the marketing and sale of foreclosed assets with comprehensive title curative services.

* LPS closing management services uses robust real time technology to facilitate communication and identify exceptions immediately.

* LPS closing specialists are state experts who manage deed preparation, review of HUD-1s, and the delivery of wire proceeds and seller funds within 24 hours of closing.

Eliminate the complications inherent in using multiple title companies and make your default title and closing services faster, easier and more cost-effective.

Source: http://www.lpsvcs.com/DefaultSolutions/DefaultTitleandClosingSolutions/Pages/default.aspx

Let me tell you, my friends, ever since I returned to America, a few months ago, renting has never felt better. And I’m renting a fully furnished ocean-front property for $1000 a month, in the resort side of town. Why would I ever want to own anything in this country?

So, my friends, it’s time to let go of the American Dream, and start enjoying life. Gotta go… Time to hit the waves…

Psychoanalystus

Have been looking around the Napa region for a new home this year and the number of distress homes (foreclosure/short sales/pre=foreclosure) is growing daily and in particular in the mid to upper class neighborhoods.

The new stress now with title issues makes buying more complex something that I would not enter into without a lawyer reviewing all documents so I will postpone buying for another year and see how these issues move forward.

Amar Bhide also co-wrote an article in the Harvard Business Review in 1990 September-October issue titled:

“WHY BE HONEST IF HONESTY DOESN’T PAY”

It seems that the banks figured out how to make dishonesty pay by making so much money that two Presidencies, two political parties and today’s entire generation of politicians (yes, including many of the so-called Tea Party) have fallen and prostituted themselves for the alimighty dollar.

Thanks Harvard and its graduates…you’ve now figured out how to destroy a country, democracy and its way of life.

Just so you know, I’ve known Amar for over 25 years. There was a lot of concern about honesty, or more accurately, the lack thereof, in the wake of the Drexel/LBO bust (a lot of HBS grads like Paul Bilzerian were found to have behaved badly).

Amar had been doing work in the area of trust in contracting and went out to study the question of honesty specifically. He was so dismayed by what he found (as revealed in that HBR article) that he abandoned his line of investigation after that.

In other words, don’t shoot the messenger. Amar was most assuredly not advocating dishonesty in that piece.

As I noted at 4ClosureFraud – I am not claiming LPS was legit. My issue is with the posts stating this price sheet is a smoking gun. My belief is that this is a mountain out of a molehill story.

Did anyone try asking someone with mortgage experience about the terms create, recreate and cure? Cure is used legally the same as it is medically. For example: some of you who have mortgages may have been in the situation where you signed your name incorrectly (not as typed) and the bank made you sign the documents again. That would be a cure. If your mtg company stores all their documents on a digital document storage system – printing out the signed document package so there would be a physical pile of paper – that would be recreating the collateral.

While there are dumb criminals out there, I am really skeptical about a corporation publishing a rate sheet for illegal activity.

You don’t recreate a note, period. A note is a bearer instrument, like a check made out to cash. The very fact that they offer to recreate entire collateral files, which includes the borrower’s note, is the real estate equivalent of being a counterfeiter.

Don’t you love corporate policy that pretends to be law, flooding the economic landscape, there by becoming TBTF as it is dominate. Then our DOJ via congress critters or even the Supreme Court…breath life into it.

Skippy…lets not forget the state level too, cheaper to bribe.

Yves,

Can you comment on LPS’s discussion of this blog post from its October 6th conference call, transcribed below:

So when we see information coming out of these blogs that are not fact based we’re not going to be able to respond to

every nonfactual blog item that comes out. When you look at this particular blog that introduced this price sheet under

DOCX, this is the price sheet that relates back to early 2000, we think 2001, 4 years before we owned the entity. And

just to give you an example, when you look at that price sheet and if you really read it, it’s a legitimate service that has been provided.

What the service was and again this is not underneath us, what the service was, was basically you are talking about a

very manual environment and throughout the mortgage process documents are required not just in foreclosure. And so

what we did, because it was a very manual process to get records from counties and because there were a lot of records needed in the various transactions that occur in servicing a mortgage, we established a network or DOCX established a network of what we call runners. Employees or contractors in each significant locale that if a customer had a loan that was missing information they could call us, we would call our runner in that area, take a run down to the courthouse, then find this piece of documentation related to this loan that this lender doesn’t have in their files.

Now, if that’s fabricating evidence, okay, great. It’s not fabricating evidence, guys; it’s filling in missing documentation with legitimate documentation from the proper source, that’s the service that was being provided.

There are few possibilities as I see it: 1)the CEO of LPS doesn’t understand his own business and is simply clueless, 2) he is lying about committing fraud and is therefore committing fraud again by misleading analysts and shareholders on a public call, or 3) DOCX was actually performing a legitimate and legal service and you have misinterpreted the terms on this pricing sheet.

I would appreciate your thoughts on this matter. Thanks.

I asked this in the comments section of an earlier article on this topic, but I still haven’t figured it out.

Does anyone know what LPS’s actual liability in these types of cases is (or could be)? In any of the individual cases, has LPS been required to compensate the borrower/homeowner that lost their home based on fraudulent docs? Would that liability fall on LPS? Has LPS ever had to reimburse the bank/servicer that is their customer?

Thanks.

I’m mostly wondering b/c of the WashPost article on OneWest earlier this week, where the bank employee says they didn’t check all the documents b/c LPS was doing it.

Link: http://voices.washingtonpost.com/political-economy/2010/09/onewest_bank_employee_not_more.html

On class action lawsuit was filed in federal Court in Ky on 9/28/10 under the RICO law and it names EVERYONE–the original lenders, wall street, the “LPS’s”, the LAWYERS, the notaries, the Trustees. Only a few at this point are named by corporate or personal name, but their later inclusion was provided for.

http://stopforeclosurefraud.com/2010/09/28/florida-supreme-court-will-not-stop-foreclosure-mills-pending-investigations-of-fraud/

In case you missed this. This abuse is very rampant

As an attorney, this is what caught my eye–

Law firms retained by Lender Processing Services also often use their own employees, posing as officer of Mortgage Electronic Registration Systems, to produce the needed Assignments.

As a “learned professional”, an attorney is personally responsible for the actions of himself and his employees. Also, general partners are personally responsible for each other’s actions– this is why law firms and accounting firms have switched to LLCs, which really is against public policy. Partners self-police each other, LLC Members do not.

Even with an LLP or LLC, an attorney cannot limit his personal liability for his own actions and those of his subordinates (associates, paralegals, clerks, etc). Even if Uncle Sam ignored the multiple counts of bank fraud, wire and mail fraud involved here, there are going to be a bushel full of disbarment proceedings resulting from this that will be used by local District Attorneys as the basis to file state fraud charges.

Hmm, another thought…

I wonder if there’s an opportunity for a lawyer (no, not me, I’m not a litigator) to use the combination of bank bailouts and mortgage fraud to file qui tam actions against lenders under the False Claims Act. That’s the law which allows private party to sue on behalf of Uncle Sam if its been cheated out money, if private plaintiff wins (on behalf of the Government), they’re awarded 20% or so of the recovered amount. Alan Grayson made a fortune in this field before going into politics.

http://en.wikipedia.org/wiki/False_Claims_Act

Your posts are generally interesting to read, but please no more offensive remarks like no tickie no laundry.

K, so it’s like this. Every conversion done by LPS/Aptitude Solutions for acclaim, showcase or oncore may/may not keep the original image. Images go through a conversion as well, like combining images into multi-page documents where needed. All images are copied and renamed and no map to the old image is maintained. There is absolutely NO validation done internally, the client is relied on for that and the errors per conversion generally exceed two years (from what i’ve witnessed). Showcase is the most poorly managed solution you can imagine. A product that is sold to a client might not go into the actual conversion phase for a year after the product is paid for! Security is a joke, there are many ways thier so called “security” is breached. I know, I worked there for nearly 2 years and I can tell you first hand, their security purely relies on the ethics of those they hire and no reporting or monitoring exists. Thier internal operations would be better run by kindergardenters. Furthermore, I’ve never seen such a lack of extreme disregard for “team”.. everyone is just trying to get theirs. So far they’ve not made even a profit this year. There are just too many bad things to say about them.. but if I were to sum it up into one word it would be “disgust”.

> POSTING ARTICLE by Rick Grant from HousingWire

Tuesday, October 5th, 2010, 11:25 am

For much of my career as a reporter covering the mortgage lending business, I have focused on technology and its promise of making things better, cheaper or faster. Sometimes, a tool can deliver more than one of these. Rarely have I seen one that delivers all three.

During the housing boom that started us on our journey into the new century, mortgage originators were happy to see any one of these promises fulfilled. Historically low interest rates, a vast array of mortgage loan product to meet any conceivable borrower’s need and a federal mandate to increase home ownership had lenders attempting to respond to an avalanche of new business. They couldn’t keep up and needed technology to do so.

It wasn’t just technology, of course, that finally allowed the industry to meet the market need for home loans, there was a fair amount of process improvement that played into that as well. Sadly, the tools and processes that empowered companies to put so many Americans into their own homes during the boom are now being called into question by attorneys who are fighting the foreclosure process.

The same borrower who could not have cared less who signed on the dotted line in order to make the loan closing happen in time to avoid inconvenience suddenly is shocked and dismayed to learn that they don’t recognize a signature on one of the documents in their closing package.

Is it possible, they and their attorneys wonder, that this person wasn’t intimately involved in the loan closing and may not have known all the details of the deal? Doesn’t this mean that the gentle borrower should get to live in his home for the rest of his life without every paying back a penny on the note?

Is this seriously a question that we’re asking ourselves? Of course you have to pay back the loan. Either that or vacate the property. The fact that you’ve been living in the house for all of this time should be plenty of evidence that you intended to enter into the mortgage agreement, whether every i was dotted and t crossed or not. But perhaps I think that because I’m still paying my mortgage loan as agreed.

We probably should have expected this, I suppose. In hindsight, it makes perfect sense that the downturn following the most phenomenal, incredible and in all other ways totally remarkable housing boom in history would also be one of biblical proportions. Did we really expect all of those folks who suddenly found themselves in possession of an American Dream they had been taught to desire would just retreat back into the rental market without a fuss when the bubble burst?

I think the typical thought process went more like: “(1) they’re telling me to sell these crazy loan products; seems stupid, but pays great; (2) I’ll be so long gone before any of this goes bad; and (3) I get paid promptly. No-brainer. Sign here. Or don’t and we’ll just get someone to sign it for you later.”

Getting past all the noise about who’s to blame for what — which bores me to no end given that the people who really scored big aren’t even on the field of play anymore — we’re ready to start fixing this problem. Unfortunately, we’re operating in the U.S. home finance industry, the business no legislator seems to have the time to really understand but that every regulator feels honor bound to write a rule about.

So, now we find ourselves in the wake of a scandal at a major servicing house where some serious corner-cutting has called our entire foreclosure process into question and the industry’s response has been to fall back into a defense position and freeze everything. If they don’t, the plaintiff’s bar will descend on them like a guillotine blade and that’ll be the end of it. The foreclosure process, the built in purge process for bad loans, is stalled again.

Who wins? For starters, about 10% of U.S. mortgage borrowers who now have a roof over their heads for free, at least for the time being. A few attorneys who serve this population who now have some real evangelists as clients who will send them additional criminal cases as they crop up (I don’t see how there can be much money to be made in working for someone who honestly can’t afford to pay his mortgage, so I figure it must be a marketing ploy). Some politicians who will earn media coverage by shaking a fist at the industry and acting like they’re standing up for all homeowners, when really they are defending a small percentage of those who are taking advantage of the rest of us with the help of some clever attorneys.

Everyone else loses. Everyone.

Am I missing something here? Readers of this column have not been shy about writing to me when they disagreed with something I’ve said. I hope I’ll hear from someone who can tell me that I’m missing a big piece of this story because, honestly, this is the stupidest thing I’ve ever seen.

Rick Grant is veteran journalist covering mortgage technology and the financial industry.

Housing Wire is a very pro bank/pro servicer site. And Paul Jackson, who runs it (and for whom I normally have respect) clearly does not have a grasp of the fact that the failure of the securitization industry to convey the notes properly (which is the real fraud here, the other stuff is just symptoms) is a very big issue for investors. Paul himself has written defenses of the servicers since this story broke that are simply and obviously wrong from a legal perspective.

Rick, you asked if you’d missed anything…well, you missed ALL the points except the cynical one about this being about seeking mortgage-free homes.

What all would you do if you gave a loan to PNC Bank for $60,000 for a new car. PNC then transferred it to BOA, who transferred it to CITI,after which it may have transferred 1-3 more times, ending up with Goldman Sachs(GS) as a vehicle backed security (VBS). Goldman Sachs had wired the money to PNC Bank when the loan was made because GS had ASKED PNC to find them loans like yours. In the VBS you now legally have 1/2 million beneficial owners of your’s & one million other new cars, and your car has been converted to a stock option. Although FEDERAL LAW REQUIRES you to be notified of each sale/transfer, you were NEVER notified of any of them.

However, in order to qualify for a VBS, your promissory note had to be “Satisfied”, leaving only the premise that you will still honor it because they bank on the fact you want to keep your car (and, of course, you do not know that it’s been paid off). Then the VBS secures credit ins on your loan, from 3 or more insurers to also cover their lost profits if you default. But not only can stocks not have an encumbrance against them, the profits cannot be guaranteed either (note the insurance). So, when you default your loan must be transferred again, now OUT of the VBS –away from the only people who had money in it.

The worst happens and your income drops and you miss 1-2 pmnts while trying to get some forbearance from PNC B4 they tell you they don’t own it. You try the entity who receives your pmnts and they take 4-6 mos, constantly requesting more data so they can make a decision, only to tell you “No forbearance” but don’t tell you it’s because the VBS does not allow it, which they knew in the 1st place. And they all make more by collecting the insurance pay-offs and penalties they charge you. Now you are severely behind in pymnts,(the servicer wouldn’t take any partials during the 4-6 mos.) and you learn a civil action had been initiated 1-2 mos prior–while you were negotiating with them, to reclaim your car for their resale.

They tell the Court that in the initial transferring your loan docs were lost(the Title and loan papers you signed)as they do not want you or the Court to know the VBS investments paid off your Note, and were paid-off by the insurance). The Servicer or the Attorneys then have a new Note fabricated and present it and a sworn Affidavit to the Court swearing that BOA owns your loan (which it doesn’t, of course).

The lien against your car is now messed up and you don’t even know who to pay to clear it, so you cannot sell the car to avoid its repossession. And no one will buy it without a clear title NOW–with a promise for one in the future.

Someone(s)have already recv’d $27,000 from your pymnts. Do you continue to pay knowing they cannot give you a clear title back? Or do you keep driving the car until they take it and resell it for $32,000 (all resale dollars are addit- ional profit since they’ve been paid off by insurance, so they don’t have to sell it for its worth. And they can still come after you for the remainder, anyway.)

So what would you do, Rick? Who do YOU owe? PNC never had their own money in it; none of the transferee’s did either; GS was paid by the VBS deposits; the Investors by the insurance and TARP; the insurer by TARP funds (and you had no contract with the insurer), and the TARP funds by your taxes and China–must mostly by the NEW money that was PRINTED. And regardless of whom you pay, you still cannot receive a clear title. Furthermore, because the lender who had been paid off was just getting more profit by any resale amount, their low asking prices for cars drove the value of yours down to below what you owe for it.

Fraud was committed in lack of disclosures when the loan was made; then numerous laws were broken on numerous levels thereafter; IRS rules were violated by the VBS to avoid taxes; criminal actions were committed by fabri-cations, perjuries and presentations to the Court and car owners, everyone involved made $ millions, except perhaps some investors who were swindled and defrauded, but not by YOU. The LAW does say that one cannot be enriched by violating the Law. So…?

Tell us, the “other car owners”, WHAT YOU WOULD DO, RICK.

What is the likely remedy, if any, for someone whose mortgage was in a 2006 Deutsche Bank securitized Investment Trust and was foreclosed on? Can a class-action suit be filed by former home owners against these banks?

Can their “cash for keys” program to entice homeowners out of their homes be used against banks in court? If banks knew the foreclosure was illegal, yet, they paid the proper owner a fee to vacate, is that a bribe or coercion?

Tom, a class-action lawsuit was filed in Federal Court in Kentucky that specifically names Deutsch Bank among others with MANY OTHERS YET TO BE NAMED. That suit includes those in every stage of foreclosure and those who have already gone through foreclosure, and it includes people from every state.

It is a dynamic suit that explains and appears to include ALL and EVERY violative action. It cites many costs of damages (many are treble), and allows for some to be yet named. It can be read on any of the “foreclosure fraud” websites, and gives the lawyer’s contact info to join.

Post a reply back here w/contract info if you cannot locate it and I’ll e-mail it to you.

DON’T QUIT EVEN IF IT SEEMS OVER. IT’S NOT.

Universally, experts agree that even in a BEST CASE SCENARIO, it will take many weeks to sort out who is holding the bag in all of this. Meanwhile while servicers, investors, insurers and foreclosure services companies like Lender Processing Services play HOT POTATO with liability suits, NO new foreclosures are being started. Most servicers are worried about their own liability with regard to obviously questionable document “re-creation” practices. Recently, a deposition from a Robo-signer in one of the largest document “fixers” testified that she had her own notary stamp, even though she wasn’t a notary. It’s like opening up Tuts Tomb. Untold treasures yet to be beheld. Better break out the emergency supplies Lender Processing Services, and make sure you bottle up lots of water… it’s gonna be dry, dry, oh so dry.

I am opposed to both legal and illegal immigration. This country is overpopulated, and 21 million Americans are out of work.

Wow, this website is awesome…. very very informative. Kudos!

I just want to vent what I think is an injustice… I apologize beforehand if this is not the forum to do so.

I have a friend who bought two +500k homes and not on his own credit nor SSN. I believe they both were pick’n pays with Countrywide. Needless to say, he stoped making his mortgage payments on both and has been squatting in the first for over 3 years and renting out the second to his relatives/squatters… for 3 years! He has also been collecting unemployment and food stamps. He’s been saving the money he earns under the table from an unreported job, saving what would have been his mortage payment and keeping the rent from the second home he rents out to his in-laws. He’s been able to do this becuase he has a realtor friend who knows how to deal with the banks and the courts and continue to delay foreclosure and he has no intent on changing the course. He claims he has enough money saved up to buy another house cash down and will do so if he finally has to be removed from the premises. Kudos for him and too bad for the banks… I guess, reluctantly.

But here is where the resentment comes…. I have not bought a home mostly for the reason that my work requires that I have to relocate frequently. So I have been renting for the last 7 years. I now do have a family with children and see the need to settle down in one city now that the girls have started preschool. I have very good credit (780 last I checked as does my wife 766 mid-FICO’s) and carry almost no debt (just pay off all my credit cards every month)… auto loans, student loans all paid off. I am now just waiting for housing to bottom ( I am anally risk adverse and even frugal). I hope to be able to buy a house with 50% down… but the way this is going I may be able to just wait longer, save more, and just buy it out without a mortgage or even buy more than I really need and carry a mortgage.

What irrates me is that I have been a saving and waiting for the right time (I had seen the bubble brewing)and city to settle into, and now someone like my friend and more people like him who have been saving as they have been squatting and reaping rental benefits and now will also be able to buy even though they are bearing no responsibility for the mess they previously got themselves into. Furthermore, with foreclosure delays… he could continue to squat collect more rent and save tons more than me! And now that BoA-Countywide has delayed foreclosures again…. he will definitely stash more in the mattress!!!!!!!!!!!!!

Don’t get me wrong, I appreciate my friend (not sure if I should keep him as one), but this seems wrong and I think it is the responsible homeowner that is getting screwed and (some of) the irresponsible ones are benefiting. I don’t mean to make blanket statements for I know people who lost their homes and have endured much suffering. In my friend’s case, he is just beating the system at taxpayer (my) expense.

What we have here is much “lawyering” and “quasi lawyering” of a situation created by “lawyering”.

We should recognize it and other messes for what they are and stop such activity NOW.